Why insurance CIOs need cover for failure demand and how AI can help

The CIO has a tough job. To push a company forward into revolutionary new territory like AI that nobody is 100% familiar with (yet) but can 100% see the benefit of while battling with existing technology systems that are woefully ill-equipped to live up to the demands of a new digital age. If anything, jamming everything up like an old-fashioned printer.

What’s a CIO to do?

The 2021 CIO Agenda for insurers from advisory company Gartner shows that customers have started using a wider selection of digital channels. And they’ll naturally be getting more familiar with them as they go. That’s no surprise to you or me since, a CIO or not a CIO, we’re all consumers too and we’ve all been spending more time online out of choice or pure force because of Covid-19.

And expectations of digital customer service are high.

If insurance companies can satisfy that high expectation for excellent customer service, it helps prevent savvy customers from switching insurers because they’re happiest where they are.

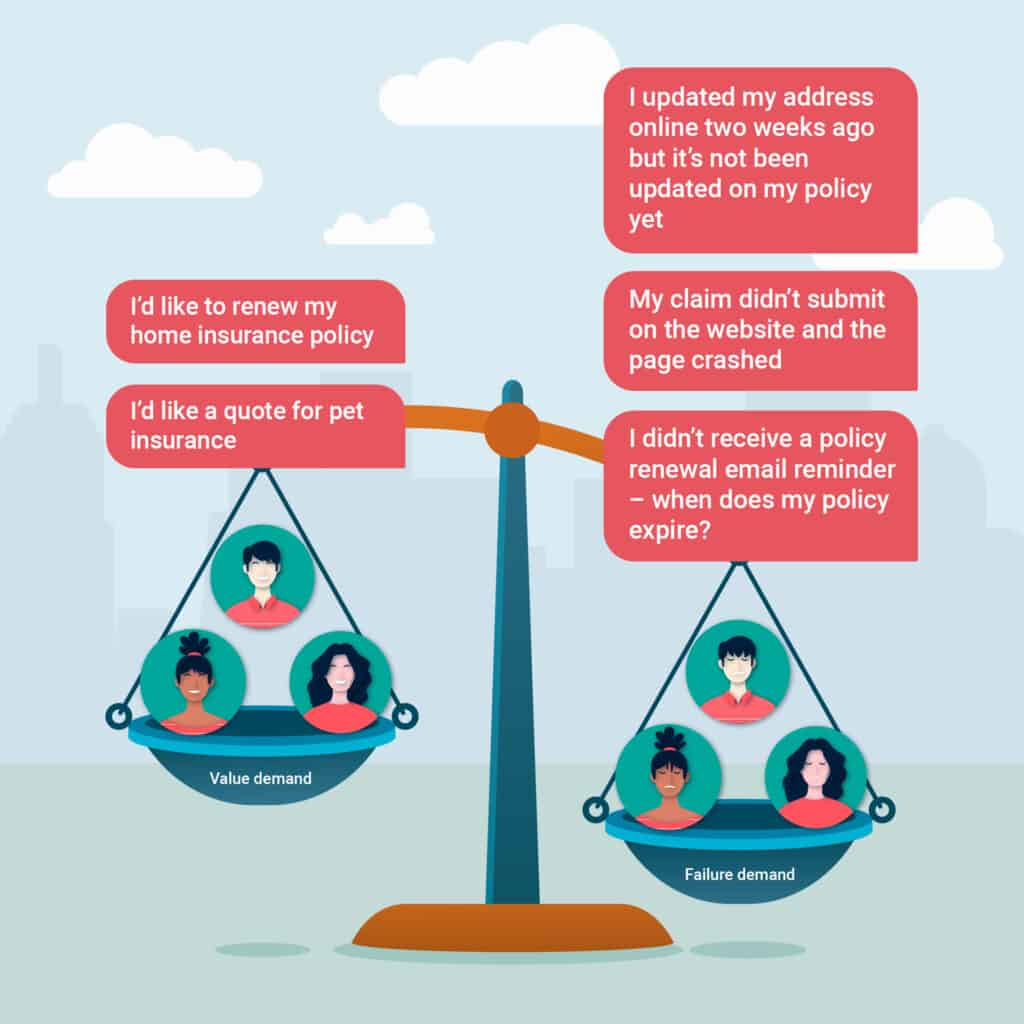

So now, “38% of insurance CIOs are increasing their investment in AI,” says Gartner. Insurance companies are choosing conversational AI because, in some cases, the highest percentage of customer service activity is a result of failure demand. And that’s not good. Because failure demand is about making mistakes or letting things slip or not getting back to your customers fast enough. That irks people because they’re forced to get in touch with you for something out of their control. And even if that exchange goes well, it will always be better if it didn’t have to happen at all.

That’s where artificial intelligence has got your back.

40-80% of company activity is a result of failure demand

40-80% of company activity is a result of failure demand

Occupational psychologist, managing director and author, Professor John Seddon, claims that up to 80% of company activity at your insurance firm (or any business in the private sector) is driven by failure demand. That means a significant number of your customers are getting in touch with you because something went wrong or didn’t happen or got forgotten.

Somebody calls in to change their address but, for whatever reason, it isn’t changed and so they have to call in again.

That’s two phone calls instead of one.

You’re paying to post a letter to the wrong address. Then you have to send it again.

The worst part is the loss of the customer’s faith that you can best serve their needs.

Imagine if 80% of the time your customer support staff are taking calls that could have been prevented ― all that time wasted. With frustration building on both sides.

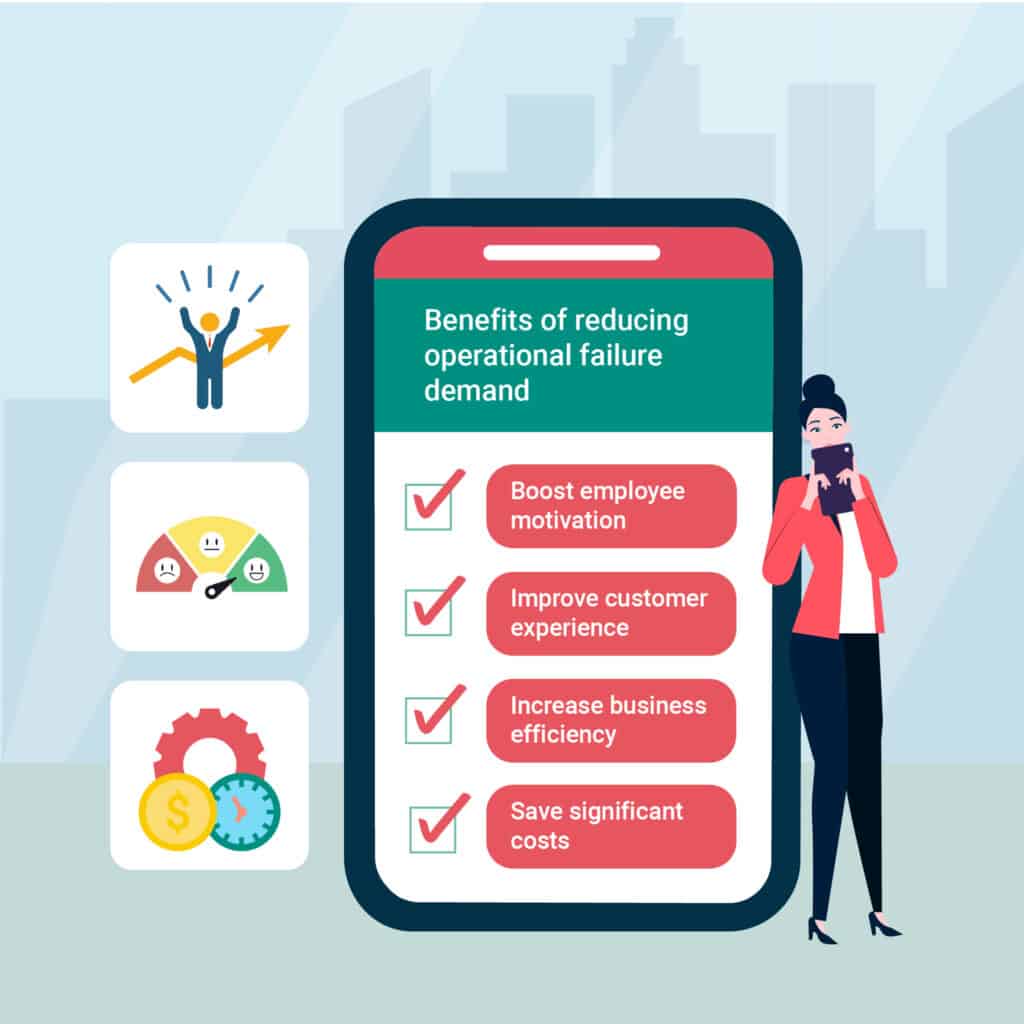

That dent in your reputation doesn’t have to be there when you use conversational AI. You can start exceeding people’s expectations and win more business as a result.

Tackle failure demand head-on with an AI assistant

Let’s take a look at some of the ways an AI assistant can help you reduce failure demand in your business today.

See in real-time what’s working and not working in your business

Having an AI assistant on your website, phone line, mobile app, or any device where customers contact you about their insurance gives you live data. That means you can see straight away if lots of people are asking the same question. This could be sudden and reveal that a web page or online payment feature is broken, making it impossible for customers to do what they want to do ― including pay you! Or that information on a particular subject is too hard to find or not clear so the customer has to ask for clarity.

With an AI assistant, you’re feeding it new information all the time. Straight away, the AI assistant can start sending out whatever information you give it. Even if 50,000 people got in touch at the same time to say they want to buy your new service but want to check first how much it is. All of those people get the same answer, instantly, at the same time. You’ll soon know where your website or app is going wrong, if tasks are routinely not getting done, or customer requests for something specific aren’t being acted upon.

Free up contact centre agents to build better relationships with your customers

Say you’re on the lower end of Seddon’s scale and your customer service agents are only dealing with failure demand 40% of the time, not 80%. That’s still wasting away half of their time dealing with queries that shouldn’t demand their attention at all. The vast majority of your most essential routine enquiries can all be dealt with by an AI assistant.

The person who wants to change their address can speak to an AI assistant on your website using their mobile, wherever they are, any time of the day or night.

They’ll be asked for security information just like they would be over the phone before checking the new address.

The AI assistant changes it there and then and the customer has instant confirmation.

Letters start going to the new address straight away.

And your customer service agent doesn’t have to speak to the customer at all. They’re able to spend their time helping someone else with a far more complex or sensitive query that needs the human touch.

Using a combination of fast, accurate AI and time-rich, empathetic human agents, every kind of customer enquiry gets the highest level of customer service support.

Failure becomes a thing of the past with EBI.AI

Using our advanced conversational AI platform, we’ve been helping insurers like Legal & General Insurance with thousands of routine enquiries every month. 95% of them are handled by the AI assistant we created for them, SmartHelp.

Securely connected to their policy system, SmartHelp helps their customers with everything from getting a quote for insurance to claiming for accidental damage.

Failure demand is like wet rot, seeping through the foundations of your business. If you want to see how AI can help prevent and treat it, we’re happy to show you. Just book a demo.

Book a demo

Want to see how our platform works? We'd love to show you!

40-80% of company activity is a result of failure demand

40-80% of company activity is a result of failure demand